This is one home budget category that depends very much on your own preferences. For most families, it will also include your cell phone, cable, and internet expenses. That includes your gas, electricity, water, and sewage bills. Your utilities category should cover all the expenses that keep these services up and running. Water, electricity, and HVAC (heating, ventilation, and air conditioning) are vital to practically every well-functioning household. The basic idea behind your budget categories is to split them up so you can see what you really need to spend separately from what you’re choosing to spend. However, if you’re someone who tends to spend a significant amount of money on things like gourmet food and wine, you might want to put your non-grocery food expenses into one of the non-essential categories. Many budgeters include dining out in this category (e.g., restaurant meals, work lunches, food delivery, etc.) Groceries, of course, are an essential expense for every family.

#Family household budget registration#

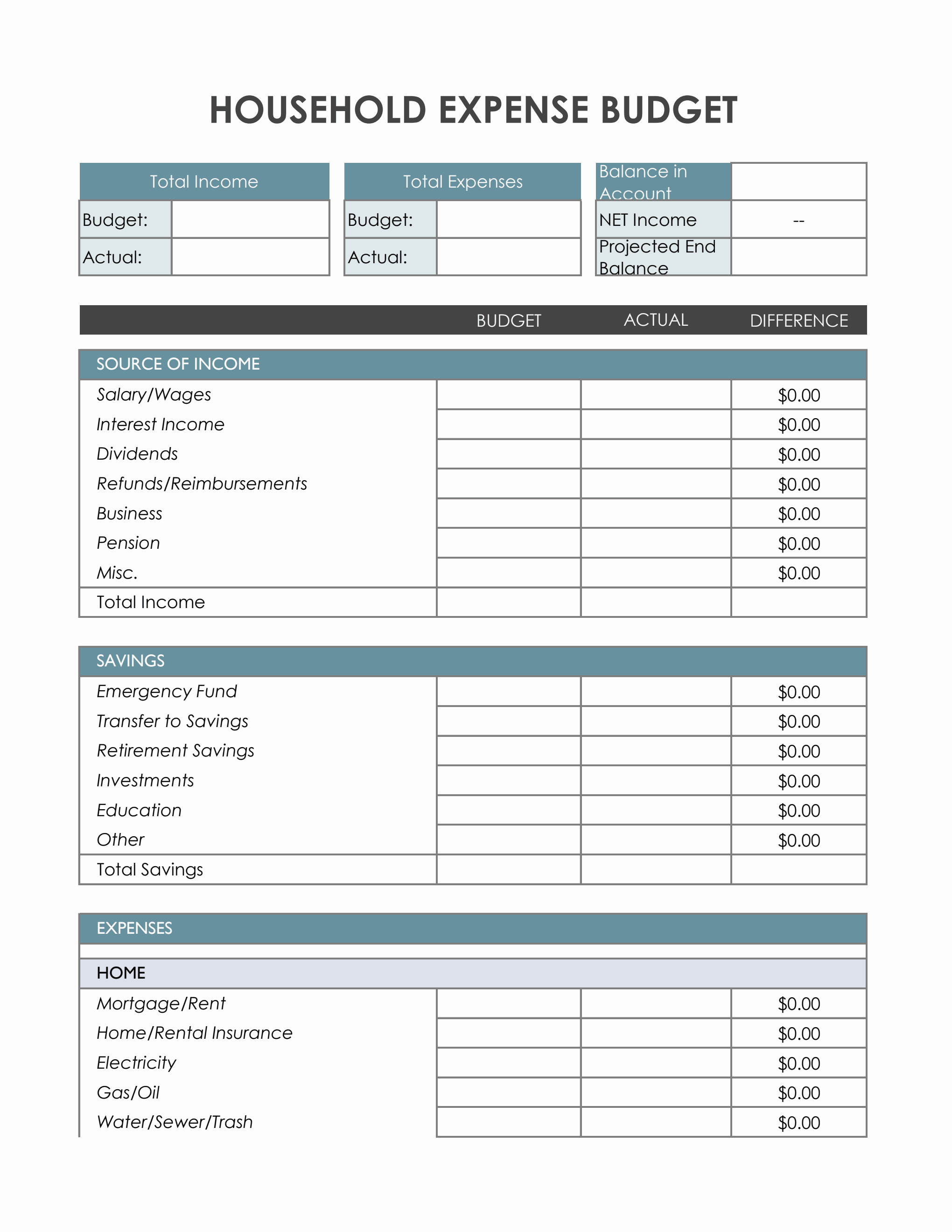

Typically, this budget category includes car payments, registration and DMV fees, gas, maintenance, parking, tolls, and public transit. Regardless of your location or lifestyle, everyone needs to get from point A to point B. For most budgeters, this category is by far the biggest. That includes rent or mortgage payments, property taxes, HOA dues, and home maintenance costs. Housing (25-35 percent)Īnything you pay toward keeping a roof over your head is considered a housing expense. Your disposable income is what you have available to spend on your home budget categories: housing, transportation, food, utilities, insurance premiums, and other essential costs. Assembling Your Home Budget Categories The Essential Budget CategoriesĪll monthly budgets start with your disposable income-the money you take home from your paycheck after taxes, retirement savings, and other deductions. It also offers suggestions for how much of your income you should devote to each category. This guide reviews a list of budget categories found in a basic household budget. Once you’ve identified your basic budget categories, you can start allocating your spending based on your unique financial situation. The first step involves breaking down your regular expenses into budget categories to get a clear picture of your spending patterns (including areas where you tend to overspend). A well-thought-out budget can help you take control of your finances and use your money with purpose, so you have enough to pay your bills, grow your savings, and still enjoy life today. If you can afford it, prepare an emergency fund which will last about 3 to 6 months.At its most basic, a budget is really just a plan for your money. If there is a sudden rise in certain expenses, find out why and come up with a plan to cut back. Base this on your bank statements and bills. Regularly review your income and expenses.

You can also talk about whether to use savings or investments to achieve your goals. Discuss and set financial goals, such as buying a new property or car, having children, keeping pets or going on holiday.

Both of you, however, should review these accounts regularly. One of you should be responsible for handling the family accounts, keeping an eye on income and spending.

0 kommentar(er)

0 kommentar(er)